Avenue South Residence

Financing

payment timeline (Financing)

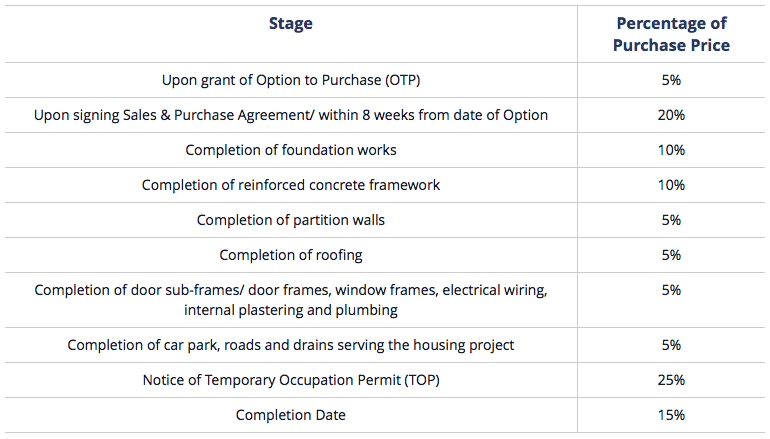

normal progressive payment scheme

Commonly known as Progressive Payment Scheme, this scheme allows you to service your loan progressively stage by stage as the development is being built.

For new properties under construction, this scheme allow you to pay for your new home in stages, according to the stage of completion.

The first 5% booking fee has to be in Cash and the next 15% can be Cash or CPF. This 20% (5% and 15%) constitutes the down-payment for your purchase and cannot be financed by a Mortgage Loan.

Find out how much you need to pay at each stage of your home construction using the Progressive Payment Online Calculator below. A step-by-step to financing your home.

taking your home loan

loan-to-value

Monetary Authority Singapore (MAS) tightened the loan-to-value ratio with effect from 6 July 2018. This will apply to loans for the purchase of residential properties where the Option To Purchase (OTP) is granted on or after 6 July 2018.

Max loan amount: 75% of Purchase Price or Valuation whichever is lower

Min. cash downpayment: 5%

Period: Max 30 years or up to 65 years whichever is lower. For loan tenures between 31-35 years (capped at age 75), the max LTV is 55% of the purchase price or valuation, whichever is lower.

Security: Mortgage of property to Bank

Interest Rate: Fixed/ Variable

Repayment: Not more than 60% of Gross Income (TDSR)

* Fixed Rate – Applies for initial period; floating rates apply thereafter

Variable Rate – Tied to reference interest rates

total debt servicing ratio (TDSR)

TDSR refers to the total monthly loan repayment ratio which is measured against your gross monthly income before any CPF deductions. It has a 60% threshold, meaning all debt obligations are not allowed to exceed 60% of a person’s gross monthly income.

On 28 Jun 2013, MAS introduced the TDSR framework for all property loans granted by financial institutions to individuals. Under this framework, banks have to ensure that borrowers’ total monthly debt repayments do not exceed 60% of their gross monthly income.

It is also important to note a haircut of 30% for all variable (refers to sources of income which is not fixed) and rental income.

For e.g.

Alex has a gross monthly income of $6000

TDSR limit is at 60%, equivalent to $3600

Servicing monthly repayments: $1500 (Car loan $1000 + Student loan $500)

Amount available for home loan: $3600 – $1500

= $2100

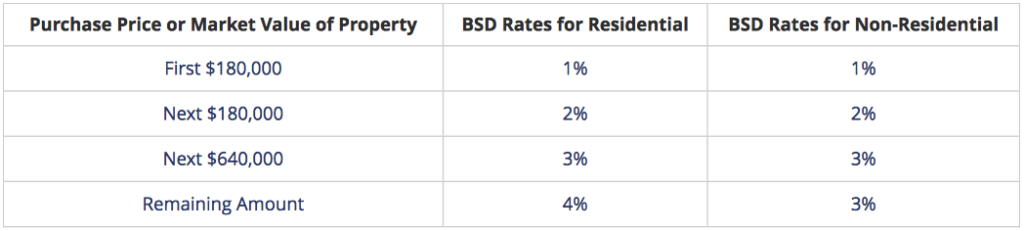

stamp duty

Buyer Stamp Duty is payable on the actual price or market price whichever is higher. It is to be paid by the Buyer (in cash) within 14 days after the signing of the S&P, if the document is signed in Singapore. Last revised on 20 February 2018.

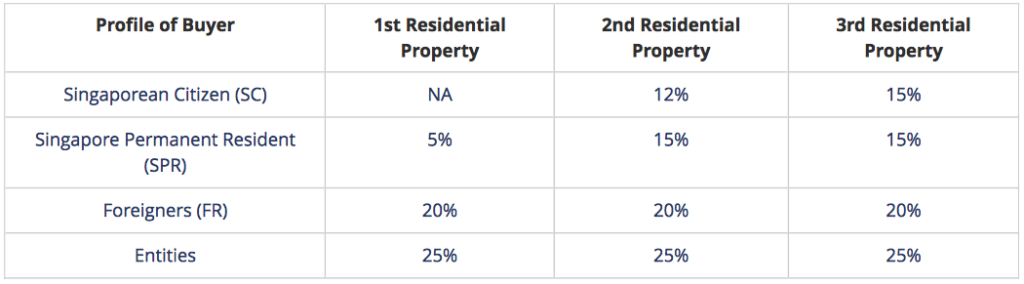

ABSD is tax payable for buyers who own more than 1 property. This is payable on top of the Buyer Stamp Duty as seen above. Taxable amount is dependent on buyer’s citizenship.

**Visit the Avenue South Residence showflat today.

You can now schedule an appointment with us here or contact our sales hotline +65 61009701 before coming down to view Avenue South Residence ShowFlat as certain days/time, we may be closed.

No commission is required for all registrants who scheduled an appointment here and you will be able entitled to receiving the Direct Developer Price. Kindly be noted that first come first serve basis policy applies to all units for sale at Avenue South Residence.

Avenue South Residence, reserved for visionaries, a glimpse into Singapore’s future. The first residential development at the doorstep of Singapore’s newest Central Business District. See URA’s master plan for the Greater Southern Waterfront.